President Joe Biden escalated his campaign to get Congress to lift the federal debt limit, hosting business leaders at the White House Wednesday and top aides warning in a new report that failure to extend the government’s borrowing authority could set off a global financial crisis.

The moves came just before indications late Wednesday that Democrats may accept a GOP offer to temporarily suspend the debt ceiling until December.

The nation faces a countdown to about Oct. 18, when the U.S. is expected to hit its debt limit and the Treasury Department will no longer be able to borrow any more money to fund government operations and pay its debts. If the U.S. doesn’t suspend the limit by then, it will default on responsibilities such as interest payments, social security and Medicare, and the economic fallout could be disastrous.

“We need to act now,” Biden said Wednesday. “Not next week, now.”

“We would likely experience a recession, millions of jobs would be lost, and the pain would endure well past the resolution of the crisis,” Treasury Secetary Janet Yellen said at the White House Wednesday.

With a sense of real urgency, Biden and Sec. Yellen hosted a number of CEOs — including the heads of banks like Citi, JP Morgan Chase and Bank of America — to underscore the severe ramifications if the government runs out of money to cover its bills.

“It has nothing to do with new spending,” the president said, adding: “It’s about paying for what we owe and preventing a catastrophic event occurring in our economy.”

Financial leaders told the president they were already seeing the impacts of a potential default and warned of years-long implications if the U.S. defaults for the first time in history.

“It’s not an exaggeration to say that even small distortions in the treasury market can cost taxpayers tens of billions of dollars over many years. Consumers can be burdened with higher borrowing costs very quickly,” said Citi CEO Jane Fraser. “We are … playing with fire.”

“We are starting to experience elevated volatility in the markets,” said Nasdaq CEO Adena Friedman. “Investors really just don’t handle uncertainty well.”

Ahead of the meeting, the White House warned that if the borrowing limit isn’t extended, it could set of a global financial crises that the United States may not be able to manage.

“A default would send shock waves through global financial markets and would likely cause credit markets worldwide to freeze up and stock markets to plunge,” the White House Council of Economic Advisers said in a new report. “Employers around the world would likely have to begin laying off workers.”

The recession that could be triggered could be worse than the 2008 financial crisis because it would come as so many nations are still struggling with the COVID-19 pandemic, the report said.

“The federal government could only stand back, helpless to address the economic maelstrom,” officials wrote.

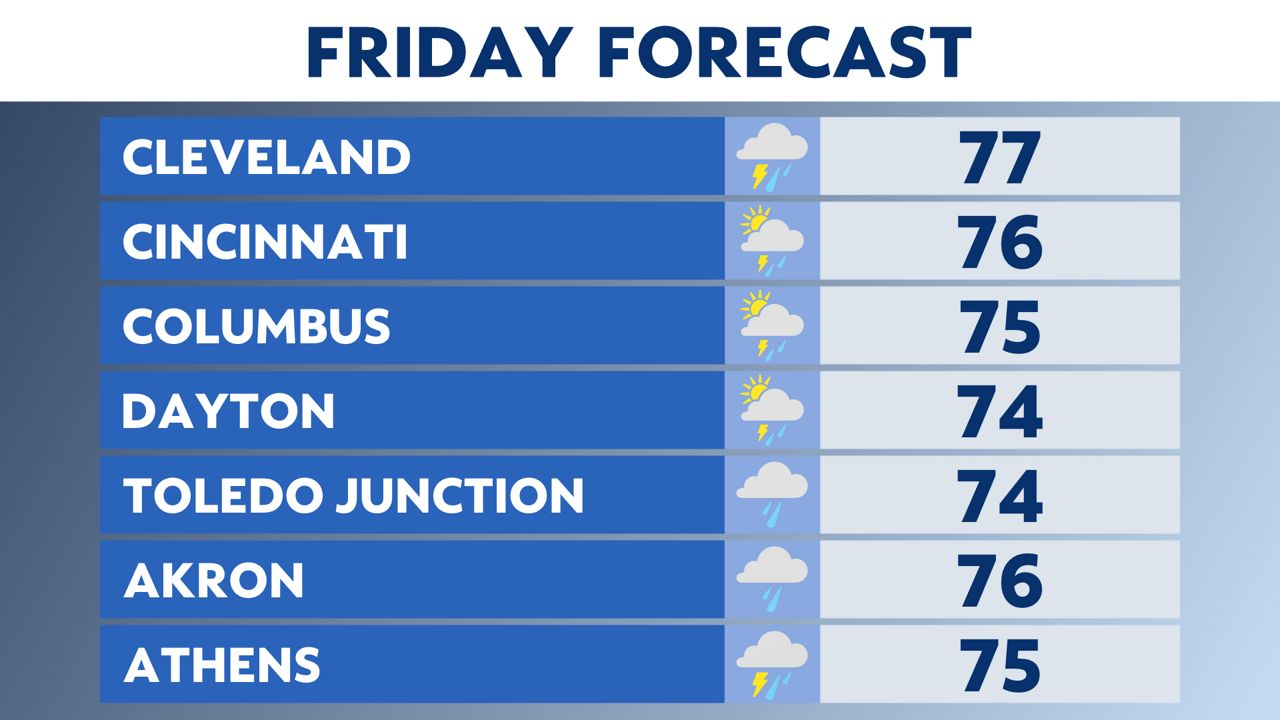

Officials warned in the report that a default could elevate mortgage rates for home buyers and disrupt federal payments for millions of Americans on Medicare, retirees receiving Social Security, members of the military and veterans and millions of others who depend on funds from the U.S. government. Critical services, such as official time keeping from the National Institute of Standards and Technology or crucial forecasts from the National Weather Service, could also be impacted, the report says.

Later, in a statement issued Wednesday afternoon, McConnell signaled that he would support Democrats using “normal procedures to pass an emergency debt limit extension at a fixed dollar amount to cover current spending levels into December,” which would give them time to raise the debt limit using reconciliation – the Senate process by which budgetary measures can be passed with a simple majority.

The Kentucky Republican added that if Democrats abandon their efforts on the larger social safety net measure – which members of the party and the White House are attempting to negotiate alongside the Senate-passed $1 trillion bipartisan infrastructure bill – “a more traditional bipartisan governing conversation could be possible.”

Utah Sen. Mitt Romney said that he is “supportive” of McConnell’s proposal on the debt limit.

Sen. Bernie Sanders, I-Vt., said the offer is a “step forward” and a “good start,” adding that he hopes “we can negotiate a process that creates long-term solution.”

“I’m glad that we are where we are,” Sanders added.

Even as Democratic lawmakers seemed positive about the development, the White House appeared to scoff at McConnell’s short-term offer.

“If we’re looking at the best options, why kick the can down the road a couple more weeks? Why create an additional layer of uncertainty?” White House press secretary Jen Psaki said. “Why not just get it done now? That’s what we’re continuing to press for.”

Following McConnell’s statement, a scheduled cloture vote on an increase to the debt limit was postponed as Democrats met to chart a path forward.

As Wednesday wore on, it appeared that Democrats were likely to accept the proposal.

“I think we’ll end up raising the debt ceiling through December,” Delaware Sen. Chris Coons said, adding that it gives Democrats the opportunity to spend the next few months focusing “on finishing [President Biden’s] Build Back Better agenda.”

Sen. Tammy Duckworth, D-Ill., said that “I think it’s great that [McConnell] folded,” but added that Democrats will not use reconciliation to lift the debt limit.

Georgia Sen. Raphael Warnock echoed Duckworth’s position, saying “we are not doing reconcilation.”

Wisconsin Sen. Tammy Baldwin told CNN it was “a temporary victory with more work to do.”

Some Democrats declared victory in the standoff: Sen. Coons said that the minority leader “blinked,” while progressive Sen. Elizabeth Warren, D-Mass., told reporters that “McConnell caved.”

Schumer emerged from the Democrats’ meeting and said he’d have something to say “later.”

Once a routine matter, raising the debt limit has become politically treacherous over the past decade or more, used by Republicans, in particular, to rail against government spending and the rising debt load, now at $28 trillion.

Both parties have contributed to the debt and the nation has run a deficit most years for decades.

The filibuster has been up for debate all year, as Biden and his allies consider ways to work around GOP opposition to much of his agenda. Biden has not backed earlier calls to end the filibuster for other topics — namely voting law changes.

But President Biden said Tuesday evening that amending the filibuster to address the debt limit is “a real possibility,” though some moderate members of the Democratic caucus have expressed reservations about such an action.

The Associated Press contributed to this report.