House Democrats grilled executives from six major oil companies Wednesday over high gas prices, while Republicans blamed President Joe Biden and his policies.

What You Need To Know

- House Democrats grilled executives from six major oil companies Wednesday over high gas prices, while Republicans blamed President Joe Biden and his policies.

- The heads of BP America, Chevron, Shell and Exxon Mobil were among those who testified — all by video link — before the House Energy and Commerce Subcommittee on Oversight and Investigations

- There was little disagreement that the Russia-Ukraine war has pushed prices at the pump over $4 a gallon on average, but both parties argued there was more to the equation

- The oil execs all insisted they are not taking advantage of the war in Ukraine to pad their profits and they do not set retail gas prices, explaining that those are established by a complex global commodity market

The heads of BP America, Chevron, Shell and Exxon Mobil were among those who testified — all by video link — before the House Energy and Commerce Subcommittee on Oversight and Investigations.

There was little disagreement that the Russia-Ukraine war has pushed prices at the pump over $4 a gallon on average, but both parties argued there was more to the equation.

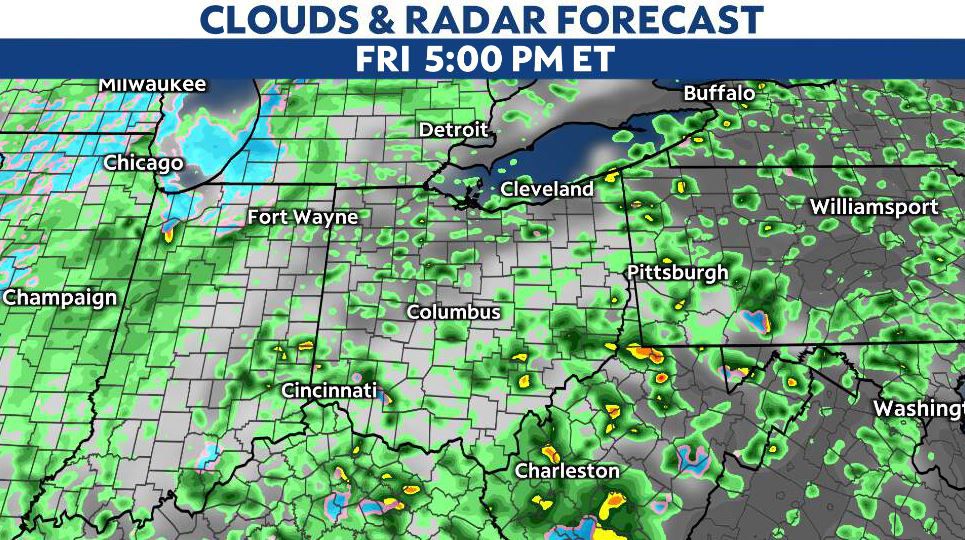

Subcommittee Chairwoman Rep. Diana DeGette, D-Colo., presented a chart showing gas prices promptly surging higher after oil prices rose in the early weeks of the war, but since oil prices have fallen, gas prices have remained relatively high. As of Wednesday, the average price of a gallon of regular gas in the U.S. was $4.16, down from a record of $4.33 on March 11.

The oil execs all insisted they are not taking advantage of the war in Ukraine to pad their profits. They said they do not set retail gas prices, explaining that those are established by a complex global commodity market that factors in supply, demand and future risk. They also argued that most gas stations, which set the final sales price, are independently owned and that sometimes there is a lag between the falling price of oil and lower prices at the pump.

“Except for here they did correlate,” DeGette said in response to an answer from Chevron Chairman and CEO Michael Wirth, as she pointed to her chart showing gas prices quickly rising after crude oil prices soared.

The Biden administration has not only pointed the finger at Russian President Vladimir Putin — coining the rise in prices “Putin’s Price Hike” — it also has blamed the oil companies, accusing them of price-gouging and not utilizing 9,000 approved leases to drill on federal land.

But Republicans have pinned the blame on Biden, who has made clear he favors a transition away from fossil fuels and toward renewable energy.

“When President Biden points to Vladimir Putin or Big Oil or other scapegoats as the culprit, I’m reminded of the words of the Wizard of Oz: ‘Pay no attention to that man standing behind the curtain,’” said Virginia Rep. Morgan Griffith, the subcommittee’s highest-ranking Republican.

“Rather than deflect blame, President Biden should consider his own culpability for higher energy prices thanks to his relentless pursuit of policies that discouraged domestic energy production, driving gas prices up to levels not seen since Mr. Biden was vice president,” she added.

Experts say the truth lies somewhere in the middle.

“COVID changed the game, not President Biden,” Patrick De Haan, a gas prices expert and head of Petroleum Analysis for GasBuddy, told The New York Times last month. “U.S. oil production fell in the last eight months of President (Donald) Trump’s tenure. Is that his fault? No.”

“The pandemic brought us to our knees,” he added.

Scott Sheffield, CEO of Pioneer Natural Resources Co., acknowledged that the industry needed to change its production model after it “overspent and overborrowed,” leading to poor stock performances in recent years.

But he said his company would face many obstacles in significantly ramping up production, including cost inflation and labor and equipment material shortages.

“Given these constraints, it would take 18 to 24 months to add any meaningful incremental production,” he said.

The other oil executives, however, said they are increasing production while also making investments in renewable energy and low-carbon fuels.

GOP panel members repeatedly criticized Biden for canceling the Keystone XL oil pipeline project and imposing moratorium on new federal leases for oil and gas production.

Various fact checks, however, have found that Republicans are overstating Biden’s ability to influence energy prices and the impact of the canceled Keystone pipeline, which was in the early stages of construction when Biden stopped work on it on his first day in office.

Asked whether the Keystone XL cancellation is the cause of high gas prices, Tom Kloza, analyst for the Oil Price Information Service, said: “A political talking point. Has nothing to do with 2022 price surge.”

The moratorium, which had been put on hold by a judge last year, did not seek to stop drilling on existing leases and was intended to be temporary while the Interior Department conducted a review, which in November recommended higher fees on drilling but not a halt to new oil and gas leases.

Wirth, however, said Wednesday he believes Biden’s policies have had a “chilling effect” on investments in drilling.

“Mixed messages from the government do not encourage us to make investments with confidence in future supply,” he said.

“That’s not a mixed message,” Griffith responded. “That’s a clearly anti-fossil fuel message from the president the United States at a time when he claims he wants increasing production.”

Democrats, meanwhile, hammered the oil companies for raking in record profits, paying dividends to stock holders and buying back their own shares while Americans are saddled with high gas prices.

“The American people want to know why they’re paying such high prices at the pump and giving your industry lavish tax breaks while your profits are being turned over to shareholders,” said Rep. Frank Pallone, D-N.J., chairman of the full House Energy and Commerce.

The oil executives acknowledged their billions in profits while noting they lost money in 2020. But Rep. Annie Kuster, D-N.H., argued if their companies had been hurting so bad financially they would not have returned so much money to shareholders.

“So please don’t use 2020 as an excuse for gouging the American people today,” she said.

Pallone asked each executive testifying if he or she would commit to increasing production while ceasing stock buybacks and dividend payouts. Only Shell USA President Gretchen Watkins said yes.

H.R. McMaster, former national security adviser under former President Donald Trump and a fellow at the Hoover Institution, a conservative think tank, testified that he believes American energy is “absolutely vital” to limit the power of authoritarians such as Putin.

By being relied upon for oil and gas, “what Russia endeavored to do was to gain coercive power over the global economy and over Europe’s economy in particular, and we all witnessed how they’ve used that coercive power over many, many years, not just in connection with the renewed invasion of Ukraine.”

“What signal does it send to our allies when the Biden administration says no to a pipeline from Canada and yes to oil from OPEC, Russia, Iran and Venezuela?” Rep. Cathy McMorris Rodgers, R-Wash., asked McMaster.

“I’d say it really makes no sense at all,” McMaster answered.

Also testifying were David Lawler, chairman and CEO of BP America and Richard Muncrief, president and CEO of Devon Energy Corporation.

The Associated Press contributed to this report.