NATIONWIDE — A group of 23 Democratic U.S. senators, including Sen. Mazie Hirono of Hawaii and Sen. Elizabeth Warren of Massachusetts, introduced on Tuesday a measure that would simplify the tax-filing process and make it easier for low-income families to receive refunds.

“We should be making it easy for individuals and families to file their taxes, but our complicated system results in too many people spending far too much time and money every year,” Hirono said. “The Tax Filing Simplification Act will help change that. By simplifying the filing process, this bill will save filers time and money, and help ensure everyone — especially families and individuals with low incomes — receive the tax refunds they qualify for.”

Supporters say the bill, authored by Sen. Elizabeth Warren, D-Mass., will save millions of Americans hours of unnecessary work and potentially hundreds of dollars in tax-preparation services by eliminating red tape and simplifying filing tools.

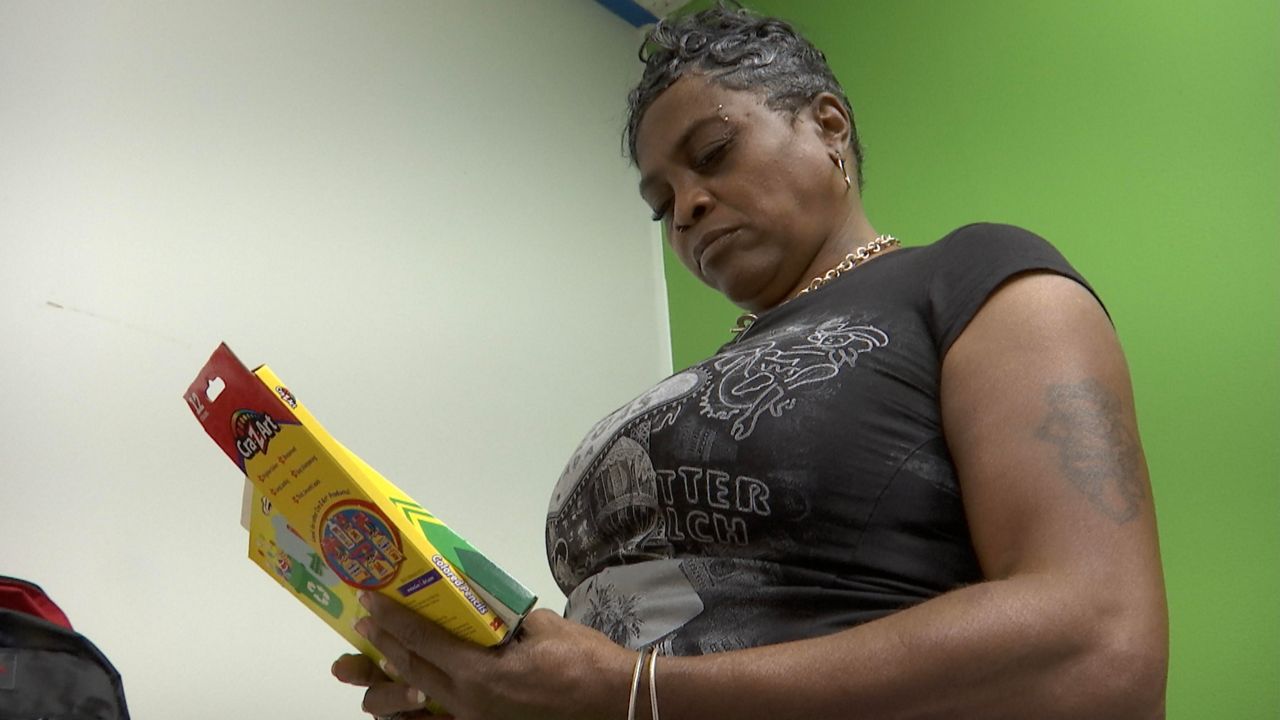

The measure is a response to what the senators characterized as years of issues with the Free File program, outsourced by the Internal Revenue Service to the tax-preparation industry. As the senators note, some 70% of taxpayers are eligible for the program, but only 3% actually use it. The program has also been plagued by complaints of abuse, including a lawsuit against Free File Alliance member Intuit for charging for filing services that should have been free.

If the legislation becomes law, it would prohibit the IRS from entering into agreements that restrict its ability to provide free online tax preparation or filing service; direct the IRS to develop a free, online tax preparation and filing service that would allow all taxpayers to file directly with the federal government without having to share private information with third parties; and enhance taxpayer data access by allowing all taxpayers to download third-party provided tax information that the IRS already has into a software program of their choice.

Other provisions allow taxpayers with simple tax situations to choose a return-free option using a pre-prepared tax return with liability or a refund amount already calculated; expand a non-filer tool to cover other tax benefits, like the earned income tax.

A House companion bill was introduced by Reps. Katie Porter and Brad Sherman, both Democrats from California.

Michael Tsai covers local and state politics for Spectrum News Hawaii.